Allianz Group Health Insurance or Allianz Company Insurance provides maximum protection for employees' assets and their families.

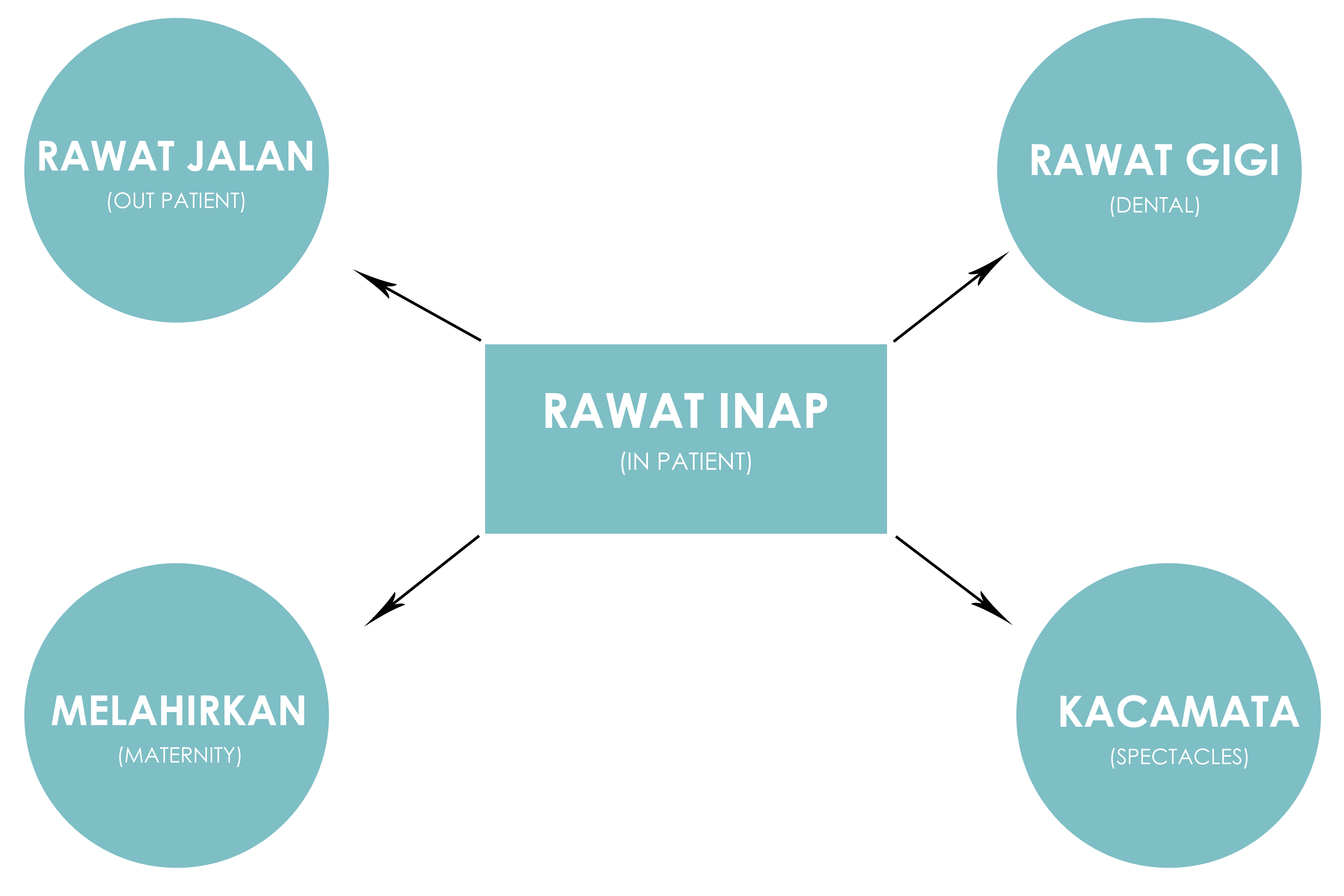

With various benefits available starting from inpatient insurance, outpatient insurance, dental insurance, and childbirth insurance< /strong> and Spectacles Insurance Allianz, which has collaborated with large corporate partners, has been proven to be the Best Insurance Company in serving customers Group Insurance.

Advantages of Company/Group Insurance Products

- Treatment, in the form of inpatient care, outpatient care, dental care, childbirth and eye glasses compensation.

- Prevention, in the form of family planning and pregnancy control.

- Examination for control, in the form of an examination for 30 days after leaving the hospital for mothers and babies.

- Employees and their families can enjoy all the benefits of health insurance by simply showing their Allianz membership card at the Allianz Network Hospital/Clinic without the need to pay a fee.

Product options available

SmartHealth Classic Premier

SmartHealth Classic Premiere

Comes with maximum protection for the company's needs in providing comfort in terms of health care for employees and their families. This product provides protection for hospitalization costs and costs for giving birth at the hospital (additional benefit).

Advantages of Classic Premier:

- Maximum replacement with the As charged system (except for room class benefits based on the Plan chosen by the company)

- Removal of the waiting period for pre-existing conditions for a minimum of 100 participants (consisting of employees & their families)

- Health care coverage up to a maximum of 70 years

- The premium is calculated based on the average age of the adult participant

- Provides convenience for employees with a cashless claim system at Allianz partner hospitals.

- Profit Sharing facilities are available for companies with applicable conditions

SmartHealth Blue Sapphire

SmartHealth Blue Sapphire

SmartHealth Blue Sapphire is a very comprehensive group health insurance program that can assist companies in providing health protection for employees and their families. SmartHealth Blue Sapphire provides protection for Hospitalization and several other additional protections as an option.

Basic Benefits

- Inpatient care

Benefits of Choice

- Outpatient

- Maternity

- Dental Care

- Spectacles

Advantages of Blue Sapphire:

- Easy requirements to own SmartHealth Blue Sapphire, only with a minimum of 10 participants (consisting of employees & their families) and a minimum premium of IDR 2,500,000.

- Claim system facilities are available with Cashless or Reimbursement as an option

- Complete protection from inpatient, outpatient, childbirth, dental care to eye glasses

- Protection until the participant is 70 years old

- There is an option for co share from 20% to 0%

- Removal of the waiting period for pre-existing conditions for a minimum of 100 participants (consisting of employees & their families)

- Profit Sharing facilities are available for companies with applicable conditions

SmartHealth Light Titanium

SmartHealth Light Titanium is a very comprehensive group health insurance program with payments in USD currency, SmartHealth Light Titanium is designed to assist companies in providing health protection for employees and their families. SmartHealth Light Titanium provides protection for Hospitalization and several other additional protections as an option.

Basic Benefits

- Inpatient (In patient)

Benefits of Choice

- Outpatient

- Maternity

- Dental Care

- Spectacles

Advantages of Light Titanium:

- Easy requirements to own SmartHealth Blue Sapphire, only with a minimum of 10 participants (consisting of employees & their families) and a minimum premium of IDR 2,500,000.

- Claim system facilities are available with Cashless or Reimbursement as an option

- Complete protection from inpatient, outpatient, childbirth, dental care to eye glasses

- Protection until the participant is 70 years old

- There is an option for co share from 20% to 0%

- Removal of the waiting period for pre-existing conditions for a minimum of 100 participants (consisting of employees & their families)

- Profit Sharing facilities are available for companies with the applicable conditions.

Need more information?

To consult regarding Corporate Health Insurance, please contact by clicking the WhatsApp button below:

Or for an illustration request, please Click Here to fill out the illustration application form by complete.

then we will contact you within 1×24 hours.