Product excellence

Payor & Spouse Payor Benefit (Rider)

Payor Benefit and Spouse Payor Benefit are premium payment protection solutions from Allianz. Have policyholders considered the continuation of life protection in the insurance policy through regular premium payments, but are unable to work due to total permanent disability or a diagnosis of a critical illness?

It is very unfortunate if the life compensation that has been prepared for your beloved family as heirs is lost due to a halt in payment of insurance premiums, so that the insurance policy becomes inactive or cancelled.

Premium payment protection solutions from Allianz

Who needs an income replacement protection solution to pay premiums?

| Life & health protection plan | Premium Payer | insured | Additional insurance product solutions | Premium benefits are paid by Allianz* if a critical illness or total permanent disability occurs to the breadwinner | |

| For yourself |

Self (as breadwinner) |

Payor Benefit | Premium Payer | Life benefits are still available for heirs** | |

|

Self (not breadwinner) |

Spouse Payor Benefit |

Partner Premium Payer |

|||

| For couples |

Self (as breadwinner) |

Partner (not breadwinner) |

Payor Benefit | Premium Payer | |

|

Self (not breadwinner) |

Partner (as breadwinner) |

Spouse Payor Benefit |

Partner Premium Payer |

||

| For children |

Self (as breadwinner) |

Child | Payor Benefit | Premium Payer | |

|

Self (not breadwinner) |

Spouse Payor Benefit |

Partner Premium Payer |

|||

If the husband and wife are joint breadwinners, they can take Payor Benefit & Spouse Payor Benefit products at the same time in the Policy

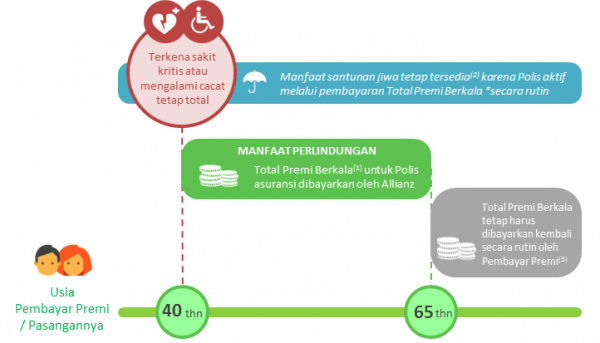

*) Until the age of the premium payer/spouse reaches 65 years of age.

**) As long as the Policy status is active according to the terms and conditions that apply in the Policy.

Illustration of Protection Benefits

- Including Periodic Top Up Premium (if any and selected as a benefit).

- As long as the regular payment of the Total Periodic Premium and Investment Fund Value is sufficient for payment of insurance fees, monthly administration fees, etc.

- Except during Leave Premium and Investment Fund Value is still sufficient to bill insurance fees, monthly administration fees etc.

Terms and conditions

- Entry age: 18 – 63 years (nearest birthday).

- Maximum age of protection: 65 years.

- The review period for total permanent disability claims is 180 days (does not apply to total permanent disability resulting in an amputation of the appropriate part stated in the policy).

- The benefit of paying the Total Periodic Premium by Allianz is starting from the next due date after the claim is received and approved.

- Exceptions apply according to the terms & conditions in the Policy.

Need more information?

To consult regarding Payor & Spouse Payor Benefit (Rider), please contact by clicking the WhatsApp button below:

Or for an illustration request, please Click Here to fill out the illustration application form by complete.

then we will contact you within 1×24 hours.